When it comes to incentives, it is important to consult a professional. You might ask, do I need a permit to install solar panels to get incentives?

We recommend speaking with both your installer and personal accountant prior to making any decisions on purchasing and having a solar array installed in your home.

Solar incentives can be great, after all, they allow the average homeowner to reap the same investment benefits that used to be reserved for large corporations and utility power plant operators. Solar is an excellent way to reduce your energy bills and help the environment.

Because the recognition of this is widely accepted, many Local, State, and the U.S. Government have various incentives designed to provide financial benefits for those choosing to install solar on their properties.

Some of these incentives are in place to make the actual installation process more efficient (thus less expensive) or reduce the period of time to recoup the initial capital outlays. These are all part of an overall objective that the United States must switch to clean, energy independence, and by installing a solar array on your own home or property, you help contribute to this effort.

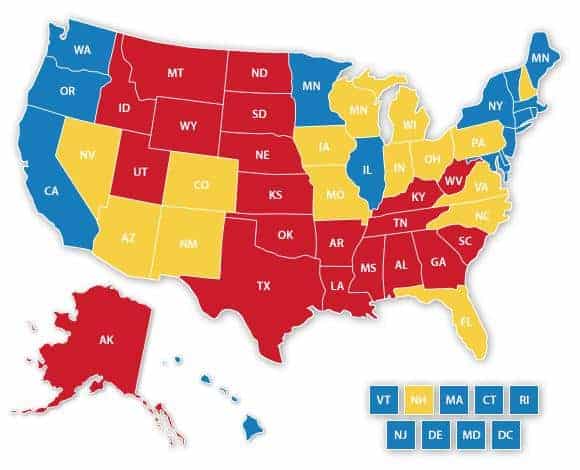

Does Your Home Qualify for Solar Tax Credits?

Click your state & answer a few questions to find out…

Solar is often referred to as the “individual’s power,” or “power for the masses,” and below are some of the incentives that you can obtain by installing solar on any property you manage. As a professional, solar incentives are usually broken into 3 categories (1) Federal, (2) State, and (3) Local, with 2 subsections (a) credits, or (b) rebates.

Incentives vary from location to location and the type of credit can either come in the form of a credit against a financial obligation or actual disbursement of funds from relevant sources.

*Please note- these incentives were in place during the time of this article being written (December, 2017). It is important to consult with a qualified and local professional to verify your personal ability to participate in each of the programs.

Federal Solar Incentives

As an individual, many of the federal incentives are designed to help you capture the same tax credits that large utility operators have enjoyed for years. Because large companies often have large tax burdens, the individual Federal Incentives help a homeowner obtain the same credits but in a way that might be more suited for an individuals tax scenario.

Individuals do not have a relatively large tax burden and therefore the federal government allows the credits to be taken which are designed in a way to benefit the individual over the corporation. These include:

- Through 12/31/21, individuals installing a solar array may recoup up to 30% of the system cost via a Residential Renewable Energy Tax Credit. This is not a deduction against your annual income but a credit on the taxes which you would otherwise have to pay. In summary: If your solar array costs $20,000, you may deduct $6,000 from your annual tax payment to the Federal Government. In many cases, if you are unable to use the full credit in a single tax year, you may consult with your personal accountant and determine if that value can be spread over several years.

- There are also several Federal Loan Guarantee Programs which are offered through FHA financing. These systems offer a guarantee instrument for various upgrades (including the installation of new solar arrays) which provide the homeowner with lower interest rates and an ability to access equity in their homes via a simpler process. Homeowner must have a meet a minimum threshold for credit worthiness (660 Score, Debt to Income Ratio of 45%) but they may be eligible for funding up to 100% of the system cost.

State Solar Incentives

If you live in Massachusetts or Maryland, we previously discussed the various incentives in these two states here; (Mass) (Maryland). The incentives in states are typically state-wide rebate programs, Interconnection Standards, Sales and Income Tax Credits, Renewable Energy Portfolio Standards, and often small grants provided through local utilities or municipalities.

An excellent resource to review what is available in your state can be found by visiting www.dsireusa.org, a website that is maintained by The N.C. Clean Energy Technology Center.

This website is widely viewed as the most comprehensive list of State and Local incentives, and it is update regularly. We also highly recommend consulting with a local professional that has experience in working within your municipality and understand the various application processes and permitting systems.

Other solar leaders are: California, North Carolina, Arizona, Nevada, New Jersey, Utah, Georgia, Texas, New York, and Maryland. Each state has various regulations, rebates, and credits.

Some local municipalities also programs which can be limited to projects installed within a city or boundary perimeter. Because the programs vary in the type and amount of offerings, it is difficult to determine trends.

Often the offering municipalities are diverse from each other and although renewable energy is often associated with more progressive ideologies, this is often not the case on local levels (remember, the current tax credit structure of solar energy was first signed into law under George W. Bush).

Related Articles:

Solar Panel Installation Costs

Local Solar Incentives

There are relatively few municipalities that offer solar incentives. Some cities and towns are very progressive when it comes to energy policies and offer incentives on top of the other federal and state incentives.

These incentives can range from a flat payment for each installation to faster or cheaper permitting processes and everything in between. Contact your local town hall for information specific to your location, but keep in mind that most cities and towns don’t offer anything.

Solar Equipment Incentives

Like any other product, there are sometimes rebates or discounts on the purchase of certain solar panels at certain times. Your installer would be familiar with these and they change over time and by manufacturer so there isn’t a better method than having the conversation with your installer.

They’ll be more than happy to help you get the best deal on the equipment.

Incentive/Rebate Glossary

Credit: A way to help the homeowner offset paying an amount that would otherwise be due. Tax Credits are common for solar energy and although the homeowner does not get a check (as they do with a grant), the credit is an amount applied against the usual tax credit (income and property tax credits).

Deduction: This is an amount that is allowed to be applied against (reducing) your taxable income. Unlike Credits, this amount is not recouped on a dollar for dollar basis. Instead it is an amount that is subtracted from your taxable income to reduce your overall tax burden.

Distributed Energy: Smaller power plants that are typically limited to localized areas or single properties/ homes.

Rebate: The same as a grant, a rebate is a program that allows for actual monetary compensation. Typically they are tied to an earmarked fund and once registered within the system you space is reserved. Grants and rebates do expire so keep up to date with these and register as soon as a design is finalized.